I’m back again. Halloween’s around the corner — Justin Trudeau is apparently dating Katy Perry, Doug Ford just tanked U.S. trade talks with a Reagan ad, and baseball fans are still recovering from that 18-inning World Series marathon.

Today, we’re talking about Wealthsimple’s C$10B valuation jump, Hudson’s Bay’s lease-to-rebrand fight, and Mark Carney’s Asia tour — his first real swing at a C$300B plan to cut Canada’s dependence on U.S. trade.

Please share this newsletter with your friends and colleagues. If this landed in your inbox second-hand, you can hop on the list directly

Wealthsimple, or Simple Wealth?

Wealthsimple just raised C$750 million at a C$10 billion valuation — double last year’s mark. It now manages C$100 billion in assets, three years ahead of schedule. The company says an IPO is still the plan, but not soon.

While most fintechs are cutting, Wealthsimple keeps growing.

The C$750 million round

They raised C$550M in new money and another C$200M in a secondary sale from early investors. New backers include Dragoneer, GIC, and CPP Investments, while Power Corp, IGM Financial, and Portage Ventures held firm.

Wealthsimple now serves 3M+ clients with 1,000 staff, offering everything from investing and crypto to chequing, taxes, and now mortgages.

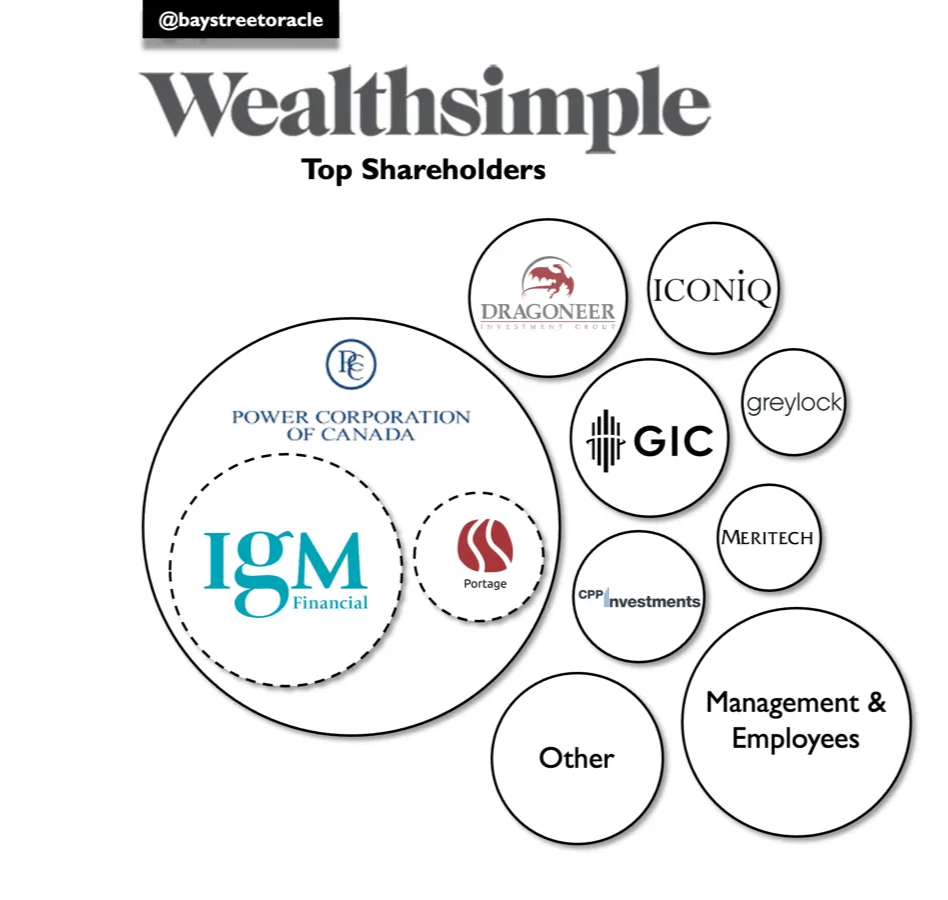

Who actually “owns” Wealthsimple?

Private markets are messy, but here’s the rough cap table based on filings and investor disclosures:

Power group (Power Corp + IGM + Portage): ~42–45%

IGM Financial: ~25–26%

Power Corp: ~15–17%

Portage Ventures: ~1–2%

Dragoneer, GIC, CPP Investments: ~1–3% each

ICONIQ, Greylock, Meritech: ~3–6% combined

Founders & employees: ~8–12%

There’s no public record yet, so treat these as directional, not definitive. Secondary trades, option pools, and side vehicles make the math fuzzy.

Disclaimer: this is approximate

What’s next?

The IPO is still coming, but they’ll wait for a better market. With C$750 million more in the bank, they don’t need to rush.

The big move is open banking — set to arrive in 2026. That will let Canadians move all their financial data and accounts with one click. Wealthsimple wants to become the one place where people see and manage everything — savings, bills, cards, investments — all in one app.

If they pull that off, banks become the plumbing and Wealthsimple owns the tap.

Next up are credit, mortgages, and smarter ways to manage cash — all still built on that same “simple” idea

Side Voices

Lol, but if you actually trade, especially in USD, then Questrade or IBKR make more sense

BSO Bottom line

Wealthsimple isn’t the underdog anymore. It’s a C$10 billion fintech that already acts like a bank — just without the marble floors or branches.

Nothing Left but the Leases

Even though Hudson’s Bay filed for bankruptcy in March, the story’s far from over.

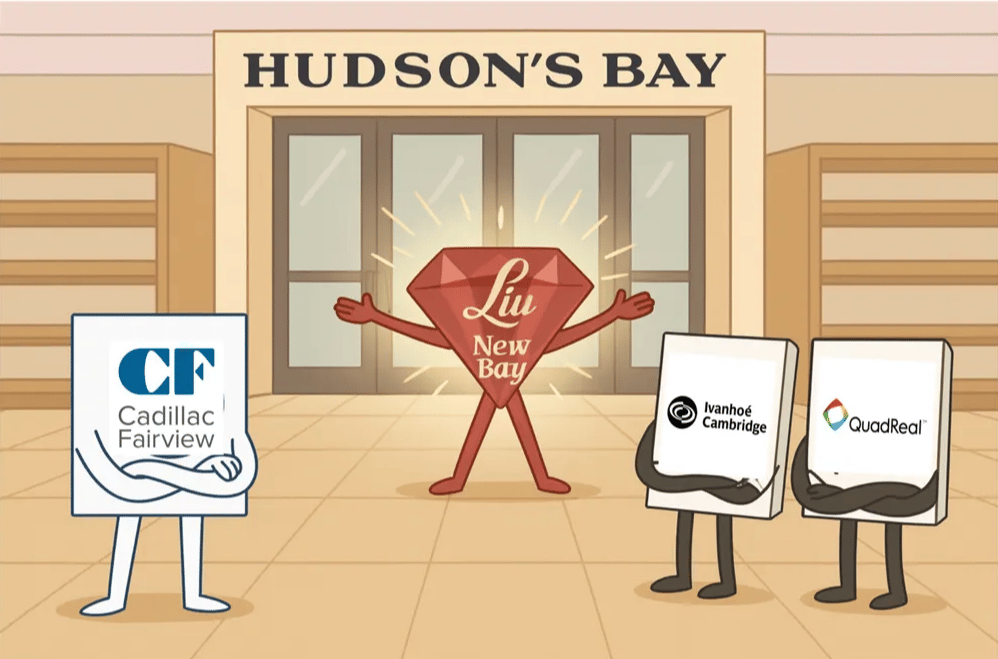

When the retailer collapsed, the real value wasn’t in the brand — it was in the leases for its prime mall stores across Canada. Those leases fell under the control of landlord-creditors, mostly the real estate arms of major pensions like Ontario Teachers’ (Cadillac Fairview), CDPQ (Ivanhoé Cambridge), and BCI (QuadReal).

Then came Ruby Liu, a Chinese developer who made US$1B selling malls in 2019. She wanted to take over 25 Bay leases and relaunch a department store chain under her own name.

The pensions said no.

They didn’t want to be forced into new long-term leases with an untested tenant pushing an outdated model. The court agreed, ruling against Liu last week.

For now, the leases stay with the landlords — and the stores stay dark.

Side Voices

It was already bankrupt. Ruby wasn’t buying the company, just trying to rent the old Bay stores and rebrand them under her own chain.

HBC’s stores were leased, not owned. The pensions didn’t want to be locked into new deals with someone they didn’t choose. Ruby Liu wanted the leases, but they didn’t trust the business plan, so the court shut it down.

BSO Bottom Line

The Bay’s gone — and the landlords aren’t nostalgic. Retail nostalgia doesn’t pay rent.

Mark Carney: The 2025 Asia Tour

After Trump’s 10% tariff hike and Doug Ford’s Reagan remix ad sent trade talks crashing, Mark Carney flew east. The trip was already planned — but now it’s become an economic stress test: can Canada survive without leaning on the U.S.?

His target: double non-U.S. exports by 2035, worth C$300B in new trade. The Asia tour is his first big swing at that goal.

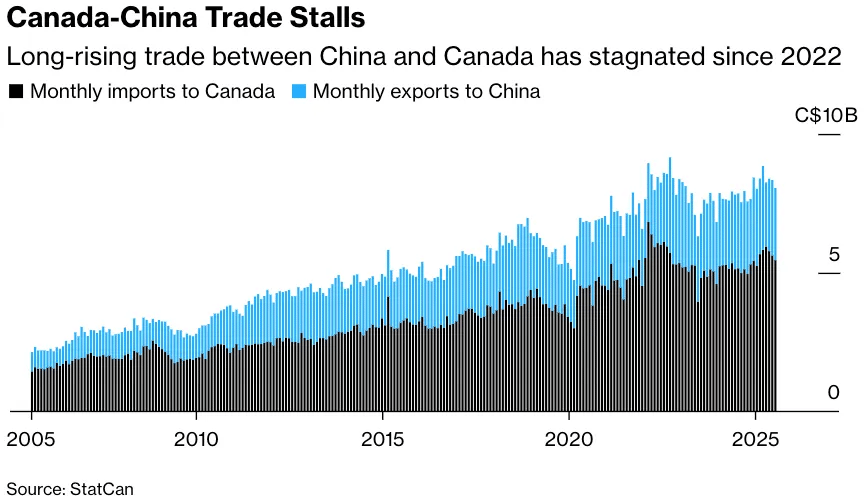

The China Reset

The trickiest stop is South Korea, where Carney’s meeting Xi Jinping for the first serious Canada–China talks in years.

Trade between the two stalled in 2022, frozen by tariffs and politics — Beijing hit Canadian barley and seafood, Ottawa hit Chinese EVs and tech. Now, Carney’s trying to thaw it just enough to reopen markets without rattling Washington.

He’ll push for agriculture, fish, and manufacturing access, pitching Canada as a steady, rules-based supplier in a world of tariff tantrums.

Too friendly, and Trump lashes out. Too cold, and China keeps Canada locked out. Either way, it’s a narrow lane.

Beyond the Photo-Ops

Behind the handshakes, this is the first real test of Carney’s diversification plan.

Energy: Partnering with Malaysia and the Philippines on LNG, nuclear, and renewables — with Petronas (already in LNG Canada) at the center.

Infrastructure: A new fast-track approvals office for “projects of national interest” — mines, pipelines, export terminals.

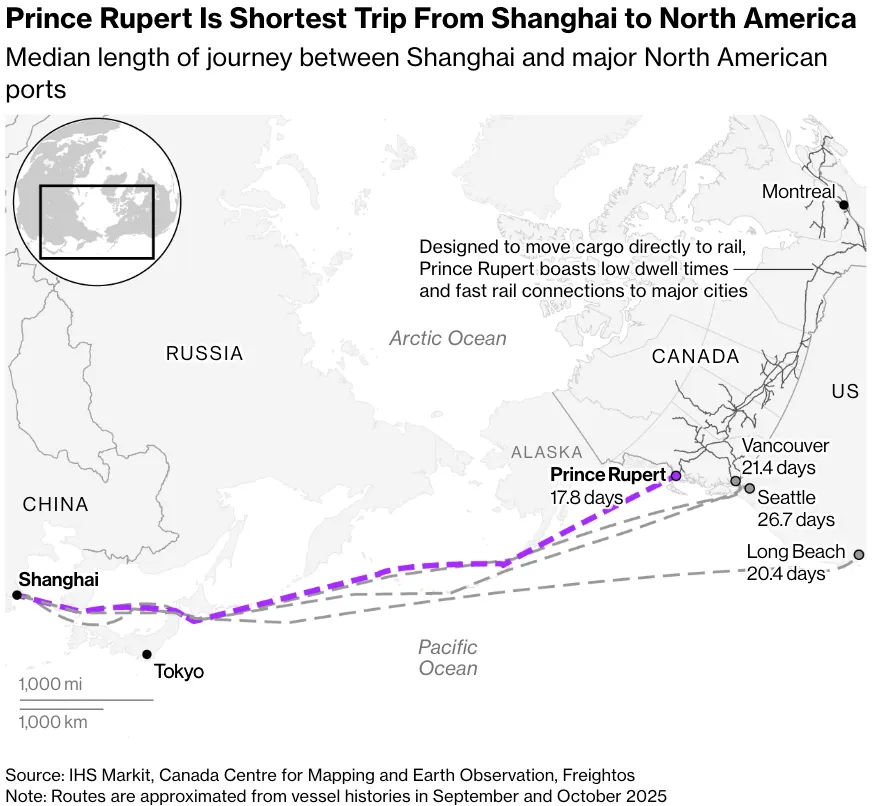

Prince Rupert: Canada’s quiet ace. The west-coast port is expanding C$3B in capacity — the shortest route to Shanghai, poised to handle 65M tons within five years. If Carney’s plan works, it becomes the hinge between Alberta’s resources and Asia’s demand.

Side Voices

Always gotta love the arguments in the comment section. 🍿

BSO Bottom Line

Carney’s trip isn’t about photo ops — it’s about finding lifeboats before Trump sinks the trade ship.

Down By the Bay

Mid-market move. Scotiabank is quietly building a mid-market M&A team to chase sub-C$500M deals. Instagram breakdown here

Wall Street imports. Scotiabank poached Young Kim from RBC and Pete Barna from Citi to lead U.S. equity capital markets under Michelle Khalili. The hires signal Scotia’s latest push to scale its ECM franchise south of the border. Instagram breakdown here

Changing guard. Victor Dodig is wrapping up his decade-long run as CIBC CEO, marking one of his final public appearances at the Canadian Club on Oct. 27. A new era at the bank starts next week.

Coming Up Next

Oct. 29 — Canadian Club Lunchtime Forum – Mirko Bibic, President & CEO of BCE Inc. and Bell Canada, takes the stage at the Fairmont Royal York from 11:45 a.m.–1:30 p.m. to discuss “building the next generation of nation-defining infrastructure.”

Earnings Shelf — Week of Oct. 28 – Busy tape ahead:

TMX Group – Reported Oct 27

Gildan Activewear – Reports Oct 29 (Before Market Open).

Canadian Pacific Kansas City – Reports Oct 29 (After Close).

Cogeco Inc., Algoma Steel Group, Restaurant Brands International, Magna International, and CN Rail – all slated to release Q3 results later this week.

Get in Touch

Send tips, feedback, or story ideas: [email protected]

Or find us on Instagram: @baystreetoracle

And Youtube: https://www.youtube.com/@baystreetoracle