Hey everyone,

as you probably saw, Canada’s federal budget was released this week (see the full 493-page budget here).

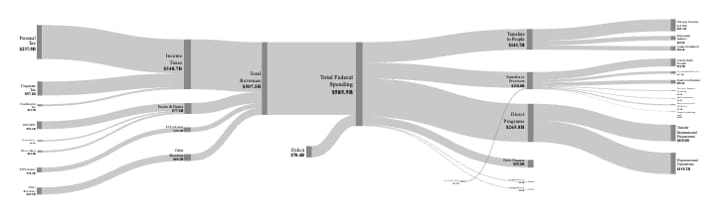

I made a Sankey diagram to show how the money actually flows through the budget, and it seems like people liked it, which is great.

Anyways, here’s the Dropbox link to download the full-resolution SVG file.

If you’re interested, below is a short breakdown of the numbers in what the flows actually represent.

Budgetary Revenues

Ottawa expects to collect about C$507.5B this year. Most of it comes from income taxes — the personal kind, followed by what corporations pay. The rest comes from the GST, excise duties, employment insurance premiums, and revenue from Crown corporations and fees.

It’s a familiar mix. Canada’s public finances still rely on steady jobs, stable profits, and consumers spending money. Nothing dramatic, just the same foundations that have carried past budgets.

Budgetary Expenses

Total spending is projected at C$585.9B, which leaves a C$78.4B deficit. The shortfall will be covered through borrowing.

The money spreads across a few main categories. Transfers to people — like seniors’ benefits, EI, and family programs — take up about a quarter of spending. Transfers to provinces cover health, education, and social services. The rest goes to operating federal departments, public debt charges, and smaller adjustments.

It’s a big number, but the structure hasn’t changed much. Most of the spending supports income and services that flow directly back to households.

Where the Money Goes

The largest programs remain consistent. Old Age Security and GIS cost C$83.1B, Employment Insurance is C$30.5B, and the Canada Child Benefit adds C$30.1B.

Provinces receive C$54.7B for health care, C$17.4B for social transfers, and C$26.2B in equalization payments. Another C$7.9B supports early learning and child care. Smaller programs fund territories, municipalities, and infrastructure.

Operational spending is also substantial — C$115.6B in transfers and procurement, and C$150.2B to keep federal departments running. Together, they form nearly half of total expenses.

Budgetary Balance

The numbers close where they usually do.

Revenues: C$507.5B

Expenses: C$585.9B

Deficit: C$78.4B

The government frames this as a balance between restraint and investment — spending less on administration while increasing capital projects like housing, defense, and infrastructure.

Canada continues to hold the lowest debt-to-GDP ratio in the G7, which gives it room to act. But the challenge remains the same: keeping that position while managing higher spending in a slower economy.

Get in Touch

Send tips, feedback, or story ideas: [email protected]

Or find us on Instagram: @baystreetoracle

And Youtube: https://www.youtube.com/@baystreetoracle